Where (Tax) Credit is Due

NetTax is a tech-forward administrator of the Work Opportunity Tax Credit (WOTC) and federal and state tax incentive programs. Offering software, consultation, and management services - we help our clients make more money and pay less tax (saving over $100 million and counting).

A Better Approach:

Software and Service

At NetTax we believe you should have the best of both worlds. This is why we approach our clients with a consultative and hands-on service. Backed by software that reduces the majority of the manual work involved in the process, our team works within your existing onboarding to ensure a smooth process and to maximize compliance; in turn, maximizing your incentives.

We strive to be a true partner, and in this spirit, we do not get paid unless you do.

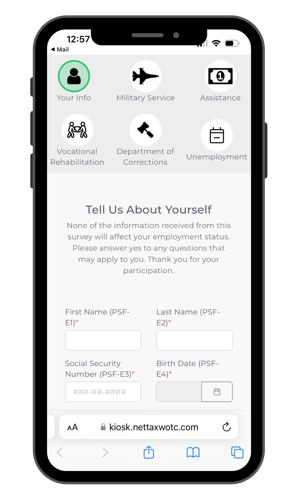

Our WOTC Portal

By investing in our technology, we invest in our clients. This is why, unlike other tax credit service providers, we have created a bespoke WOTC portal to streamline compliance and boost your savings. With real-time tracking, automated reports, and seamless integration into your onboarding process, you'll stay ahead of deadlines and maximize your tax credits with ease.

Our portal, in combination with our team’s white-glove implementation service, helps ensure timely compliance and clearly identifies eligible employees - the cornerstones of the WOTC program.

Federal and State Tax Incentive Programs

In addition to the Work Opportunity Tax Credit, you may be eligible for a variety of tax incentive programs offered by the federal government, or state and local tax (SALT) incentives.

Our team of tax credit specialists can help identify these opportunities, determine eligibility, complete any required analysis, and assist in the filing process.

Let's Talk Tax Credits

We help our clients make more money and pay less tax, and we want to help you.